social security tax limit 2021

Any earnings above that. In 2021 the Social Security earnings limit is 18960 to still receive full benefits.

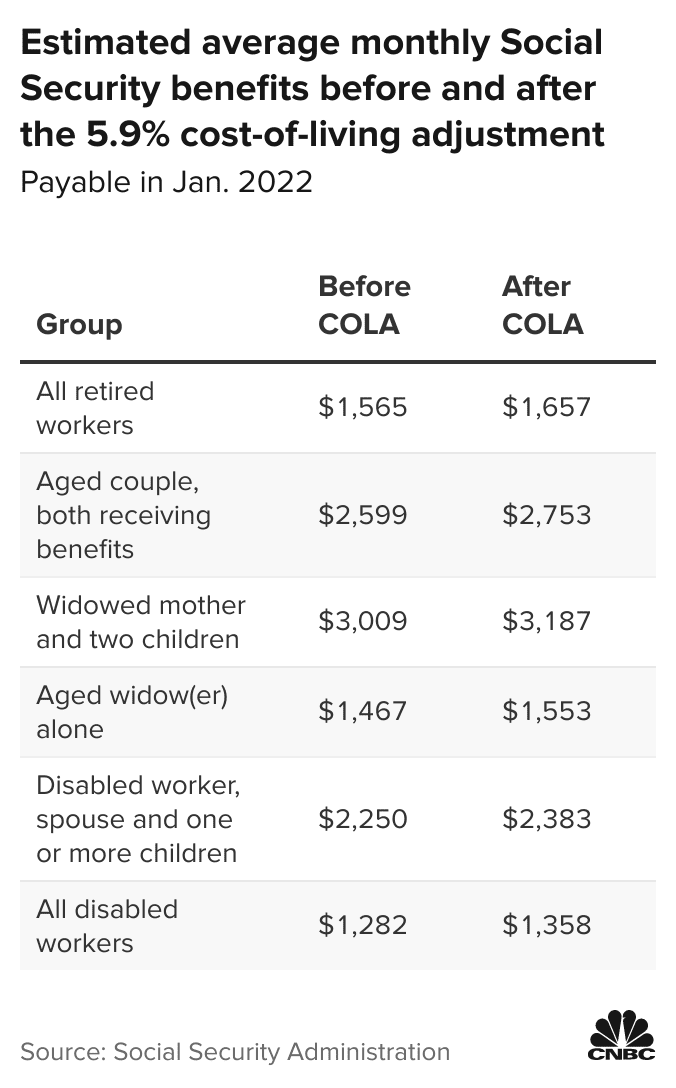

5 9 Social Security Cost Of Living Adjustment Takes Effect This Month

In 2021 the maximum social security tax is.

. The tax rate for Social Security tax is 62 Both the employee and employer must pay this percentage so the SSA will receive a total of 124 of your wages. You arent required to pay the Social Security tax on any income beyond the Social Security Wage Base. 62 Social Security tax on the first 142800 of wages maximum tax is 885360 62 of 142800 plus.

Worksheet to Determine if Benefits May Be Taxable. In 2021 this limit is 147000 up from the 2020 limit of 142800. Most of The Retirement Changes in 2021 Are For The Better.

Anything you earn over that annual limit will not be subject to Social Security taxes. 2021 Social SecuritySSIMedicare Information Social Security Program Old Age Survivors and Disability Insurance OASDI 2021 Maximum Taxable Earnings. 1 2021 the maximum earnings subject to the Social Security payroll tax will increase by 5100 to 142800up from the 137700 maximum for 2020 the Social.

This also provides a foundation of income for retirees disabled workers and their dependents and survivors of deceased workers. The 2021 tax limit is 5100 more than the 2020 taxable maximum. The wage base limit is the maximum wage thats subject to the tax for that year.

This is the largest increase in a decade and could mean a higher tax bill for some high earners. This means that if you earn more than this amount from another source like a part-time job then your benefits. Social Securitys Old-Age Survivors and Disability Insurance OASDI program limits the amount of earnings subject to taxation for a given year.

The Social Security taxable maximum is adjusted each year to keep up with changes in average wages. This means that you will not be required to pay any additional Social. B One-half of amount on line A.

If they are married filing jointly they should take half. A Amount of Social Security or Railroad Retirement Benefits. 62 of each employees first.

In 2021 the contribution limit is 885360 142800 X 0062. For earnings in 2022. In 2021 the Social Security tax limit is 142800 up from 137700 in 2020.

For 2021 the maximum taxable earnings limit is 142800. Find Out More Today. 145 Medicare tax on the first.

IRS Tax Tip 2021-66 May 12 2021 Taxpayers receiving Social Security benefits may have to pay federal income tax on a portion of those benefits. In addition your future benefit amount will not. If they are single and that total comes to more than 25000 then part of their Social Security benefits may be taxable.

Quarter of 2019 through the third quarter of 2020 Social Security and Supplemental Security Income SSI beneficiaries will receive a 13 percent COLA for 2021. Ad What Every Retirement Saver Needs to Know. When you work you earn credits toward Social Security benefits.

Wage Base Limits. In 2021 employees were required to pay a 62 Social Security tax with their employer matching that payment on income of up to 142800. The maximum amount of Social Security tax an employee will have withheld from their paycheck in.

S tarting Jan. The Social Security Old-Age Survivors and Disability Insurance taxable wage base is to increase to 142800 for 2021 up from 137700 for 2020 the Social Security. New Rules For Savers Beneficiaries Taxpayers.

If you withhold more than 9114 2022 or 885360 2021 you surpassed the wage base and must. The maximum amount of earnings subject to Social Security tax will rise 29 to 147000 from 142800 in 2021. The number of credits you need to be eligible for Social Security benefits depends on your age and the type of benefit for which.

The employers Social Security payroll tax rate for 2021 January 1 through December 31 2021 is the same as the employees Social Security payroll tax. Only the social security tax has a wage base limit. That means a bigger tax bill for about 12 million high-earning.

9 rows This amount is known as the maximum taxable earnings and changes each year. In 2022 the Social Security tax limit is 147000 up from 142800 in 2021. If you file as an individual with a total income thats less than 25000 you wont have to pay taxes on your Social Security benefits in 2021 according to the Social Security.

The Social Security tax limit in 2021 is 885360. For 2021 an employee will pay.

Understanding Your Tax Forms The W 2

/GettyImages-576720420-27eaa138a2e144d2b957315f18ef2725.jpg)

Social Security Tax Definition

Self Employed Social Security Tax Deferral Repayment Info

The Social Security Wage Base Is Increasing In 2022 Sensiba San Filippo

Social Security Tax Limit For 2022 Explained Fingerlakes1 Com

/1040-SR2022-44e2ed8aefeb4c65a07f875e2b3e173f.jpeg)

Form 1040 Sr U S Tax Return For Seniors Definition

Fica Tax Rate 2022 How Can You Adjust You Social Security And Medicare Taxes Marca

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

Social Security Wage Base Increases To 142 800 For 2021

/GettyImages-963811020-4a28b09314ec43108714573b93e1fcae.jpg)

How Is Social Security Tax Calculated

What Are The Major Federal Payroll Taxes And How Much Money Do They Raise Tax Policy Center

How Much Does An Employer Pay In Payroll Taxes Payroll Tax Rate

/GettyImages-908062776-91d6c9a754fb45ab8de8513244b5a036.jpg)

Are Social Security Benefits Taxable After Age 62

What Is The Social Security Tax Limit Social Security Us News

Full Retirement Age For Getting Social Security The Motley Fool

Social Security Taxes 2022 Are Payroll Taxes Changing In 2022 Marca

What Is The Social Security Tax Limit Social Security Us News

The Maximum Social Security Benefit Explained

2021 Instructions For Schedule H 2021 Internal Revenue Service